Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Blog Article

The Best Guide To Mileagewise - Reconstructing Mileage Logs

Table of ContentsWhat Does Mileagewise - Reconstructing Mileage Logs Do?Mileagewise - Reconstructing Mileage Logs Things To Know Before You BuyFacts About Mileagewise - Reconstructing Mileage Logs UncoveredMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneThe Only Guide to Mileagewise - Reconstructing Mileage LogsFacts About Mileagewise - Reconstructing Mileage Logs RevealedThe Buzz on Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance function suggests the quickest driving course to your employees' destination. This feature boosts performance and contributes to set you back financial savings, making it a vital property for businesses with a mobile workforce. Timeero's Suggested Course feature additionally enhances liability and efficiency. Workers can contrast the suggested path with the real course taken.Such a method to reporting and conformity streamlines the often intricate task of taking care of mileage expenses. There are several advantages linked with using Timeero to keep track of mileage. Allow's take an appearance at several of the application's most remarkable functions. With a relied on mileage monitoring tool, like Timeero there is no need to bother with unintentionally leaving out a day or piece of details on timesheets when tax time comes.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

These additional verification measures will certainly keep the Internal revenue service from having a factor to object your gas mileage records. With accurate mileage tracking innovation, your staff members do not have to make rough mileage quotes or also stress about mileage expense monitoring.

If an employee drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all automobile expenses (best mileage tracker app). You will certainly require to proceed tracking gas mileage for job also if you're making use of the real expense method. Keeping gas mileage documents is the only method to separate service and personal miles and supply the evidence to the IRS

Most gas mileage trackers let you log your journeys manually while calculating the range and repayment amounts for you. Lots of also come with real-time trip monitoring - you require to begin the application at the beginning of your trip and stop it when you reach your final location. These apps log your start and end addresses, and time stamps, along with the total range and compensation amount.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

This includes expenses such as fuel, upkeep, insurance policy, and the vehicle's depreciation. For these expenses to be considered insurance deductible, the vehicle ought to be utilized for service objectives.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

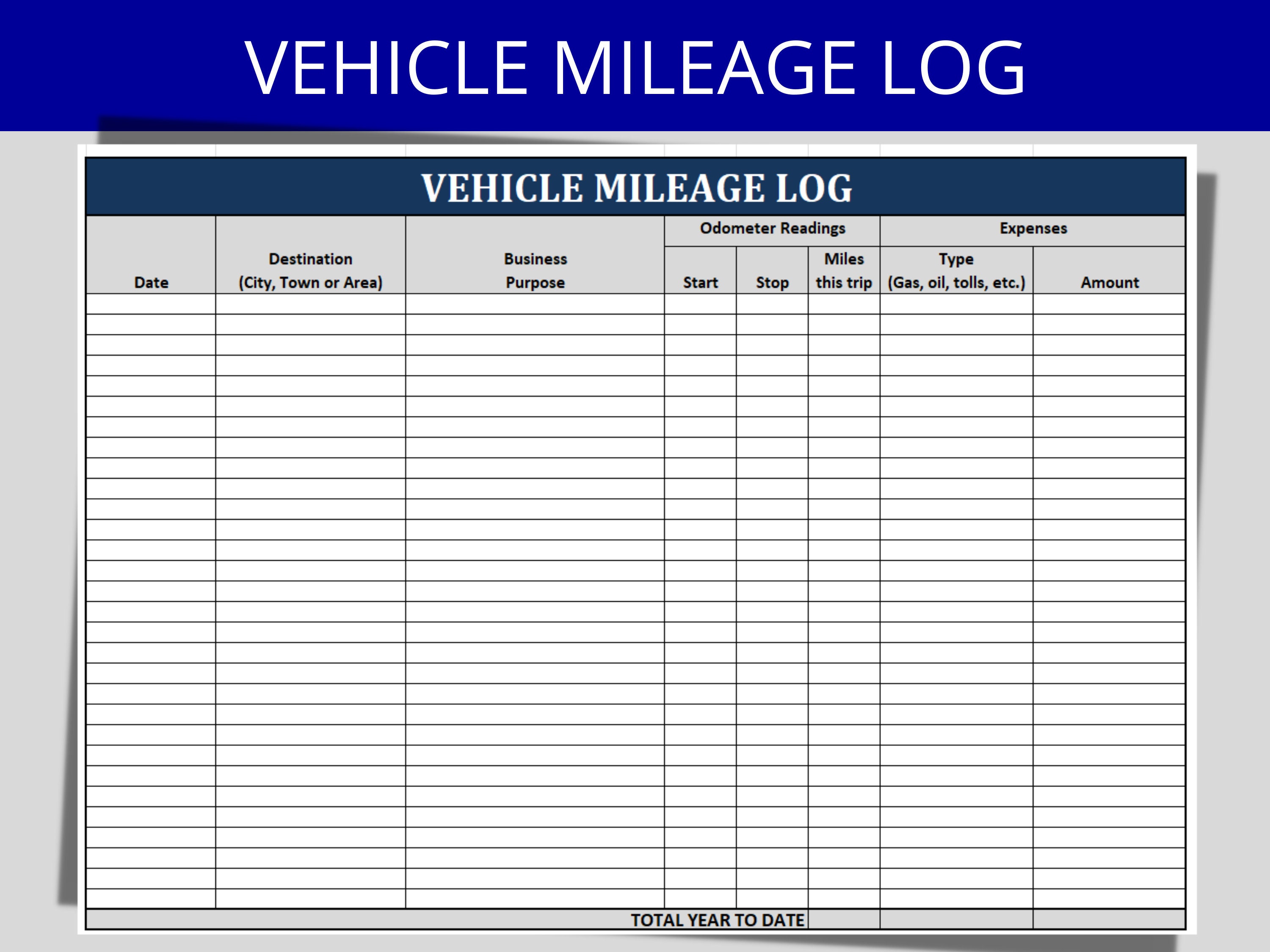

Beginning by videotaping your cars and truck's odometer analysis on January first and after that again at the end of the year. In between, diligently track all your organization journeys keeping in mind down the beginning and ending analyses. For every trip, record the area and organization function. This can be simplified by keeping a driving visit your car.

This includes the total company mileage and overall mileage build-up for the year (service + individual), trip's day, location, and purpose. It's vital to record activities immediately and preserve a synchronic driving log detailing day, miles driven, and business purpose. Right here's just how you can boost record-keeping for audit purposes: Beginning with making certain a thorough mileage log for all business-related traveling.

The Definitive Guide for Mileagewise - Reconstructing Mileage Logs

The actual expenditures method is an alternative to the typical gas mileage rate method. Instead of computing your deduction based upon a predetermined rate per mile, the actual expenses technique permits you to subtract the actual expenses connected with using your car for company purposes - best mileage tracker app. These prices consist of gas, upkeep, repair services, insurance coverage, depreciation, and various other associated expenditures

Nonetheless, those with substantial vehicle-related expenditures or special problems might profit from the actual costs technique. Please note electing S-corp standing can transform this computation. Ultimately, your selected method ought to straighten with your certain financial objectives and tax obligation circumstance. The Criterion Gas Mileage Price is a procedure provided every year by the IRS to determine the deductible costs of running a car for organization.

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

(https://www.twitch.tv/mi1eagewise/about)Compute your total service miles by using your start and end odometer analyses, and your videotaped service miles. Properly tracking your exact mileage for service trips aids in corroborating your tax deduction, particularly if you decide for the Standard Mileage approach.

Maintaining track of your mileage manually can call for diligence, yet keep in mind, it might conserve you cash on your tax obligations. Videotape the complete gas mileage driven.

Mileagewise - Reconstructing Mileage Logs - An Overview

In the 1980s, the airline company industry became the first business customers of general practitioner. By the 2000s, the delivery market had taken on general practitioners to track bundles. And now virtually every person makes use of GPS to get about. That suggests almost everyone can be tracked as they go about their organization. And there's snag.

Report this page